URD 2022

-

1. Corporate overview

-

1.1Activities

Quadient helps simplify the connection between people and what matters. The Company supports hundreds of thousands of customers worldwide in their quest to create relevant, personalized connections and achieve customer experience excellence.

Over the past four years, Quadient has focused its development on two growth drivers: the digitalization of business processes and customer communications, and the growth in e-commerce, which has led to increased volumes of deliveries leading to higher costs and carbon emissions control issues. The succession of crises in recent years, from the Covid-19 pandemic to the war in Ukraine and the return to high-inflation in 2022, has only increased the pressure on businesses forcing them to prioritize innovation, tight financial control and process streamlining. All areas where digital technology brings its full value.

Through targeted investments in external and organic growth, and in-depth work that has fundamentally simplified and streamlined its operations, Quadient is now a major player in helping companies achieve digital transformation and simplify their customer communication processes, building upon a solid, sustainable and profitable business model.

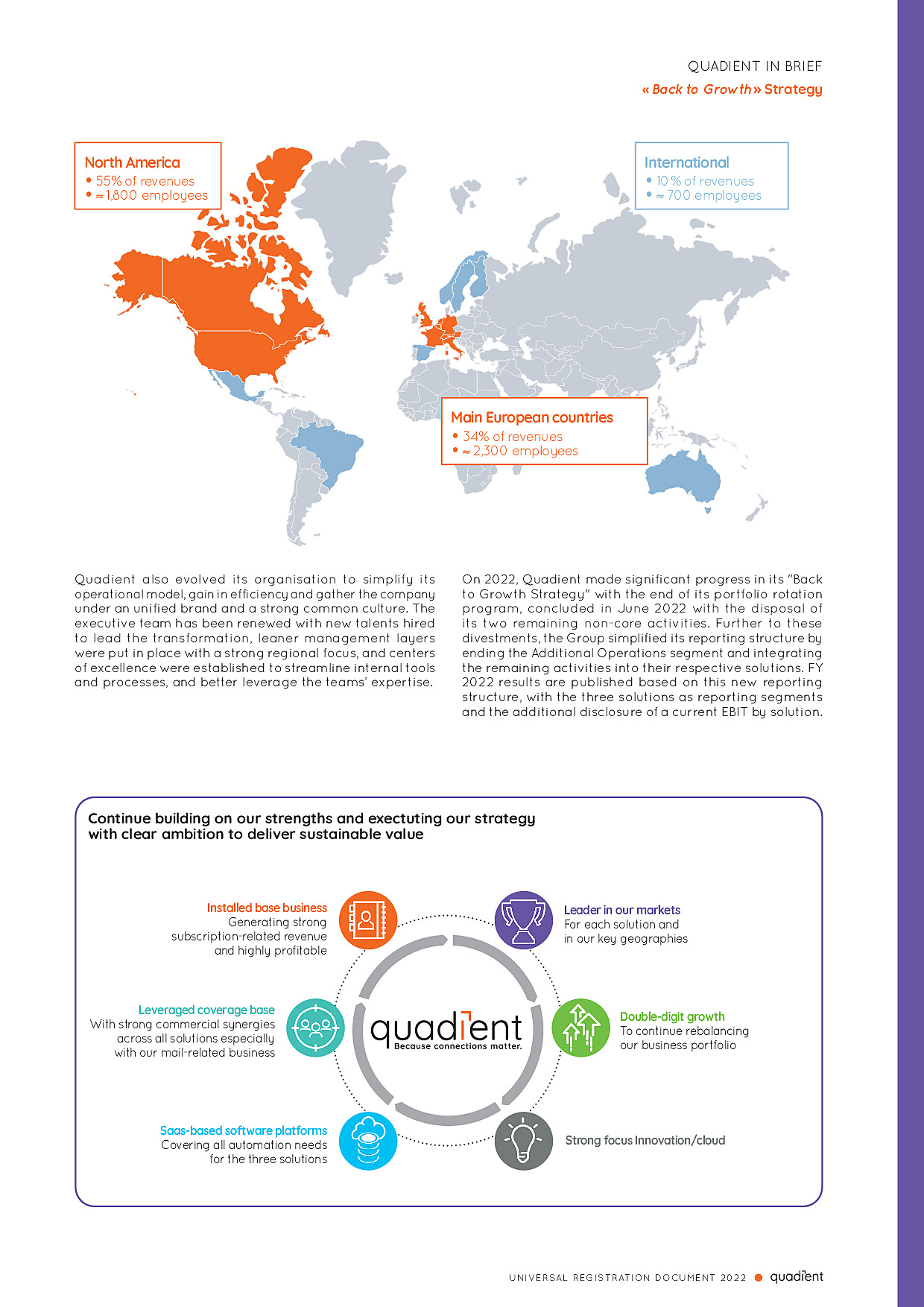

Quadient supports more than 440,000 small, medium and large businesses in 27 countries with a comprehensive hardware and software platform that facilitates billions of transactions every day, from invoicing and customer communications to multi-channel mail processing, last-mile parcel delivery and the consolidation of their return.

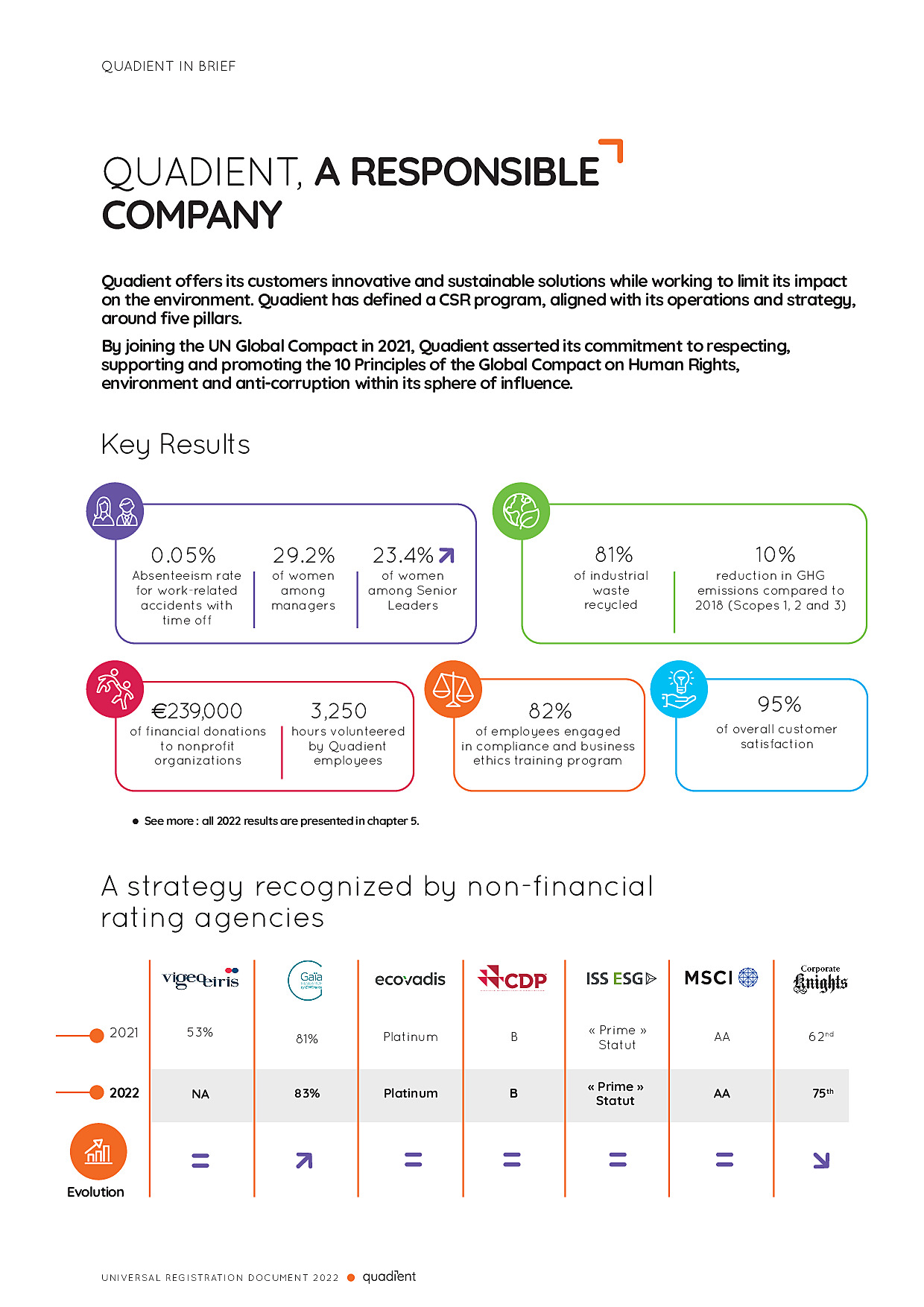

The Company is committed to responsible and sustainable growth by eco-designing its solutions, collecting and recycling equipment, as well as monitoring and minimizing the carbon footprint of its operations and solutions, which makes it a valuable partner for businesses committed to growth as well as environmental impact.

- ●Intelligent Communication Automation (ICA),

- ●Mail-Related Solutions (MRS), and

- ●Parcel Locker Solutions (PLS).

1.1.1Intelligent Communication Automation

Central to every successful customer relationship, are communications and interactions that need to be personalized and delivered at scale. Today’s organizations need intelligent solutions that make it simple to empower remote employees to connect where, when, and how their customers want. Automating critical customer communications and business processes also saves time and money, and doing it with an intelligent set of integrated technologies helps drive better customer experience and a high level of engagement from all internal and external constituents.

For businesses of all sizes who need to digitize and automate their business-critical communication activities, Quadient provides world-class integrated cloud-based solutions that help companies transform quickly, save money, and make meaningful connections with their customers. Quadient offers a true end-to-end cloud-based global business communications platform under the name of Intelligent Communication Automation.

Over 12,000 companies globally rely on Quadient’s Intelligent Communication Automation SaaS solutions to manage over a billion customer-facing communications and critical business interactions every day.

Quadient’s ICA cloud solutions help organizations enable remote workforces to create and deliver meaningful customer interactions, automate business critical workflows to save time and money as well as differentiate from competitors by delivering a better overall customer experience.

Quadient’s ICA cloud solutions support businesses in Customer Communications management (CCM) and Customer Experience management (CXM), including journey analytics and orchestration, as well as Accounts Receivable (AR) and Accounts Payable (AP) automation.

For businesses who must compete by creating exceptional customer experiences, Quadient provides omnichannel software solutions and expertise that deliver compliant and meaningful customer interactions.

These solutions enable companies to design, coordinate and harmonize all of their customer communications across various departments (sales, marketing, support, accounting, etc.), while adapting to each department’s specific needs. The Quadient Inspire SaaS suite facilitates the creation and management of transactional and marketing communication documents, regardless of the medium and the channel used (physical mail, e-mail, fax, text messages, websites, social networks, etc.) and manages omnichannel delivery for these communications.

For businesses who want to streamline document production processes and departmental workflows, Quadient’s ICA solutions help automate invoice-related communications and accelerate cash flows. The digitalization of business processes is at the heart of many organizations’ plan to ensure business continuity and cost optimization programs, particularly in the field of invoicing flows (Accounts Receivable/Accounts Payable), driven by regulations accelerating the adoption of new digital and compliant processes such as e-invoicing. It is also a key enabler of delivering a better experience for all their stakeholders: customers, partners, suppliers and employees alike.

Quadient’s ICA solutions are marketed and delivered primarily as a cloud-based SaaS (Software as a Service) model, with a legacy on-premise offering. Quadient also relies on a large network of partners to expand its footprint, integrate with other technologies or deliver specific solutions such as hybrid mail solutions

Market

Based on data from research firms and internal analyses, the ICA market is estimated to be worth around 6 billion euros in revenue, growing at more than 10% per year, driven by the digital transformation of companies and the continued focus on improving the customer experience.

Quadient software solutions remain consistently recognized as leaders in CCM, CXM, AR and AP markets, notably by IDC but also by customers and research firms such as Gartner, Forrester and Aspire.

Customers

Customers relying on Quadient’s ICA solutions include the higher range of small and medium-sized businesses, large enterprises, primarily in the financial services, insurance and healthcare industries, as well as Print Service Providers. Around 70% of ICA customers have been cross-sold from Quadient’s MRS customer base.

-

1.2Strategy

1.2.1“Back to Growth” strategy

On 23 January 2019, Geoffrey Godet, Quadient’s Chief Executive Officer, unveiled the first phase of the Company’s strategy “Back to Growth” aimed at expanding and growing the Company to reach a more balanced business profile designed to deliver sustainable and profitable organic growth going forward.

Since the launch of “Back to Growth”, Quadient has deeply transformed its operating model, simplified its organization and reshaped its product portfolio, having completed acquisitions in the business areas that had been targeted. In the meantime, Quadient has successfully developed its software and parcel locker activities, contained the decline of its mail-related business, increased the proportion of subscription-related revenue and generated significant synergies within the organization as well as within its solutions.

The second phase of the “Back to Growth” was announced in March 2021, covering the period 2021-2023. With the integration of its acquisitions, the focus was set on organic development, innovation and technology. Quadient aims at continuing to leverage its leadership positions and its strong software and smart hardware installed base to generate additional growth from its highly contributive subscription-related revenue, and further deploy cross-selling opportunities and value creation synergies across its solutions.

-

1.3Organizational structure

1.3.1Head office

Quadient S.A.’s head office is in Bagneux, France, in the Paris region. All the Company’s strategic assets, such as research and development, intellectual property, production and distribution activities described below are held by majority-owned subsidiaries of Quadient S.A., the parent Company of the Group.

-

2. Corporate governance report

On behalf of the Board of directors, I am pleased to present you with the Corporate Governance Report of the Company for the fiscal year ended 31 January 2023.

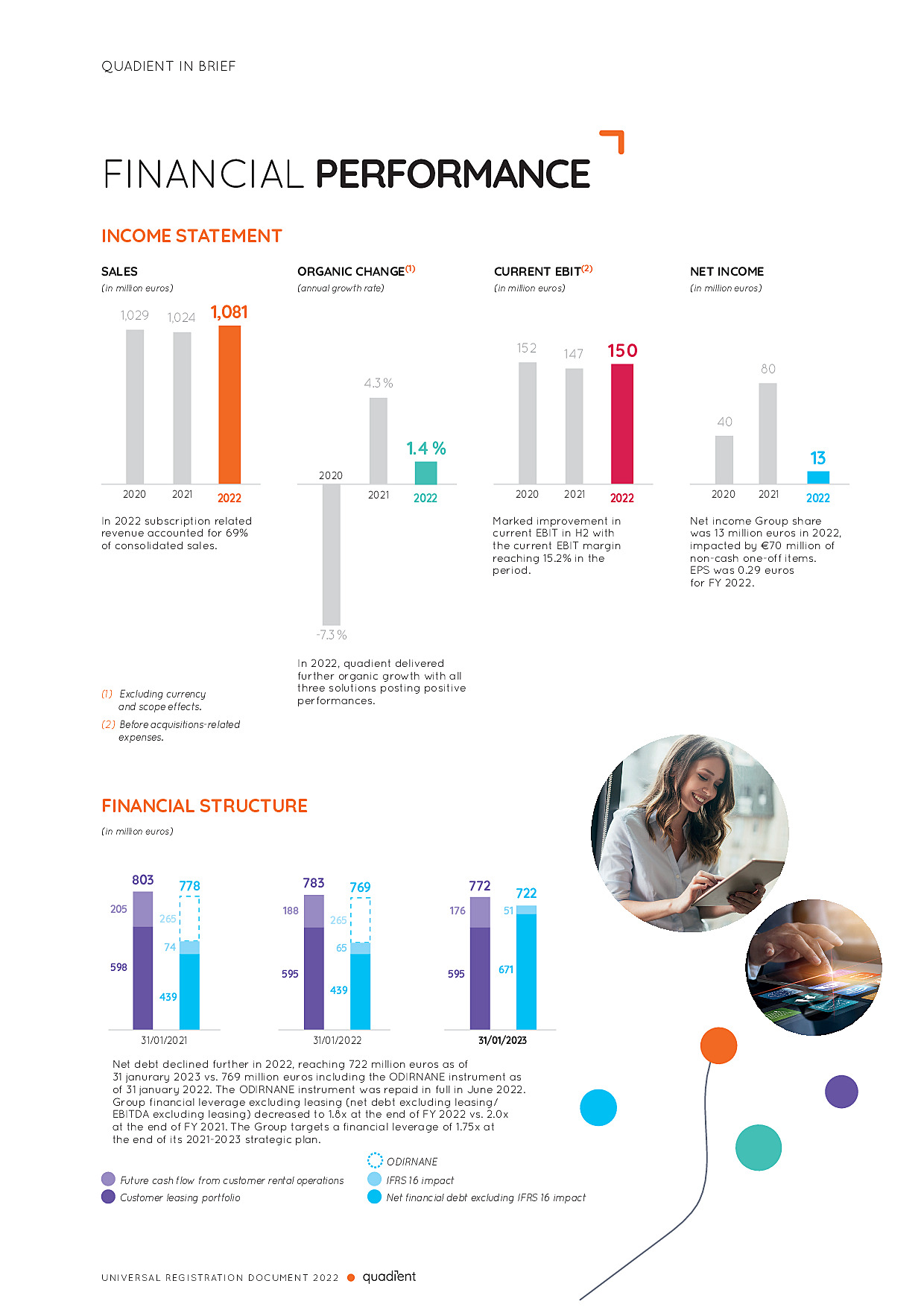

2022 was a challenging year and like many companies around the world, we were not immune to the higher cost of doing business and the challenges of competing in today’s global economy due to an intense labor market causing hard difficulties to retain and attract the best talent, high inflation and increased costs as well as supply chain delays. However, 2022 is still a year we can be proud of in many respects, with 1.08 billion euros revenue – an organic growth of 1.4% from 2021, and 150 million euros in operating profit – an organic decline of (4.8)%. Additionally, we kept our transition effort to further improve Quadient's unique and innovative subscription platform that powers billions of critical business communications for more than 440,000 customers. Our business model continued to evolve in line with our Back to Growth strategy – now, nearly 70% of our revenue is subscription-related. Finally, across our three solutions, customers continue to express high levels of satisfaction.

Having completed my first year in the role of Chair of the Appointments and remuneration committee, I am proud of Quadient’s accomplishments and excited to see what the future holds.- ●Adequacy of the CEO compensation package and executive long-term incentives programs

- ●Board effectiveness review and succession planning

- ●Governance trends and ESG developments

Quadient Board of directors has been deemed to be working well, making continuous efforts to follow Corporate Governance best practices. Following the external recommendations, the Appointment and remuneration committee engaged with the Board of directors into succession planning discussions to establish short-term and long-term strategy.

The Appointments and remuneration committee, together with the Board of directors, whilst making no fundamental change to the 2023 compensation policy of the CEO, Geoffrey Godet, has decided, however, to raise the bonus payment level upon meeting the financial criteria minimum threshold. This change was decided to avoid threshold effects as well as to provide a meaningful reward when the minimum levels are reached. Indeed, the range triggering bonus payment for financial KPIs remains narrow, and the revenue threshold has been increased this year. The minimum payout has been aligned with the market practices observed in the companies in the SBF 120.

The review of ESG objectives is an ongoing process. In line with the changes made last year, we have maintained the weight of sustainable development in the long-term incentive plan. Currently, 20% of the plan is linked to the goal of reducing greenhouse gas emissions. In 2021, the target was a 28% reduction by 2030 for Scopes 1 and 2 from the 2018 baseline. We updated this target to a 50.4% reduction by 2030 from the 2018 baseline. We have raised our ambitions and consider this new target to be demanding as we anticipate an increase in our emissions on the Scope 1, following the resumption of our activities and travel necessary to achieve the three-year plan.

There were no changes in the composition of the Board during the 2022 fiscal year. The directorships of Didier Lamouche, Nathalie Wright, Paula Felstead and mine were renewed by the General Assembly held on 16 June 2022, for a period of three years. Regarding the composition of the committees, Sebastien Marotte was appointed to the Appointments and remuneration committee in January 2023. This takes the percentage of independent directors to 75% increasing from 67% previously. The two employee representatives were appointed respectively to the Audit committee and the Strategy and corporate social responsibility committee in January 2023.

Upon the Appointments and remuneration committee's recommendation, the Board of directors decided to propose that the directorship of Mr. Eric Courteille be renewed at the next General Meeting for a period of three years.

As I present to you the performance of 2022, I'm privileged to serve in this role as Appointments and remuneration committee Chairwomen, and look forward to working with the Board of directors as we exercise our responsibility to the Company, its employees and its shareholders, and we will continue to apply the highest standards of governance in Quadient.

-

2.1Board of directors

2.1.1Governance structure

Quadient S.A., Quadient’s holding company, is a public limited company with a Board of directors ("Société anonyme à Conseil d'administration").

Quadient S.A. has made the choice of separating the function of Chairman of the Board of directors and Chief Executive Officer since the Board meeting held on 12 January 2018 on the appointment of Geoffrey Godet as Chief Executive Officer, with effect from 1 February 2018. This separation was last reiterated by the Board of directors at the meeting held on 16 June 2022 on the renewal of Didier Lamouche's mandate as Chairman of the Board. This decision reflects the Company's wish to comply with best practices in corporate governance.

The Board is led by an independent and non-executive Chairman, and comprises independent directors except for Geoffrey Godet, Chief Executive Officer, and Vincent Mercier, who lost his independence as he had been director for over than 12 years. The Board has three permanent Committees, whose members are independent except for Vincent Mercier who remains a member of the Appointment and remuneration committee and Strategy and corporate social responsibility committee.

Since February 2020, the management of conflicts of interest is carried out by the Chairman of the Board in conjunction with the Appointments and remuneration committee (the role and functions of the committees are detailed in section 2.2 of this chapter). Apart from the limitations imposed by law and regulations, limitations to the powers of the Chief Executive Officer are provided by the Board of directors’ rules of procedure as described in section 2.1.2.

-

2.2Board Committees

Audit committee Chair: É. Courteille

Strategy and corporate social responsibility committee Chair: R. Troksa

Appointments and remuneration committee Chair: M. Bejar

Martha Bejar

100%

100%

Hélène Boulet-Supau

100%

100%

Éric Courteille

100%

Vincent Mercier

100%

100%

Richard Troksa

100%

Nathalie Wright

100%

Paula Felstead

100%

Sebastien Marotte

n/a

Christophe Liaudon

n/a

Nathalie Labia

n/a

n/a : non applicable, as appointed in January 2023 with first attendance after the end of the 2022 fiscal year.

- ●Appointments and remuneration committee:

- -Vincent Mercier was chairman until March 2022. Martha Bejar is chairwoman since March 2022;

- -Sébastien Marotte is a member of the Appointments & remuneration committee since 25 January 2023.

- ●Audit committee:

- -Christophe Liaudon is a member of the Audit committee since 25 January 2023.

- ●Strategy and corporate social responsibility committee:

- -Nathalie Labia is a member of the Strategy and corporate social responsibility committee since 25 January 2023.

2.2.1Appointments and remuneration committee

This committee is composed of four directors, three of which are independent and is not composed of any executive corporate officer and met 6 times in 2022 with a 100% attendance percentage. The average length of meetings was 2 hours and 07 minutes.

This committee is composed of Vincent Mercier (chair until March 2022), Hélène Boulet-Supau, Martha Bejar, who joined the committee on September 2021 and has been chairing it since March 2022, and Sébastien Marotte who joined the committee on January 2023.

- ●proposing the definition of independent director and, where necessary, issuing an opinion on the independence of a director and suggest to the Board any changes in its composition;

- ●preselecting candidates for the Board of directors according to various criteria relevant to the Company’s need;

- ●ensuring the adequacy of the current composition, to the desirable evolution of the Board of directors and to the Group’s strategy;

- ●maintaining the required number of independent directors on the Board;

- ●setting a succession plan for the Chairman and the Chief Executive Officer (emergency and long-term succession plan);

- ●considering all matters relating to the rights and obligations of members of the Board of directors;

- ●proposing to the Board of directors the remuneration policy for the Chairman and the Chief Executive Officer, including retirement, end-of-career or termination payments, various benefits and award of stock options and for free shares;

- ●recommending the remuneration policy for directors and the way in which it is to be allocated, based on the contribution of each of the members to the Board and to the specialized committees including ad hoc committees from time to time;

- ●examining the Group’s compensation policy;

- ●reviewing the figures on remuneration, which will be published in this report and in the annex to the individual financial statements.

The committee is also informed by general management of the level of remuneration of the Company's senior leaderships.

The Appointments and remuneration committee primarily interacts with general management and the human resources department. It may commission any specific study that it deems necessary and may involve external experts. In any case it may refer to salary surveys and relevant benchmarking conducted by the human resources department.

When resolving on remuneration, committees are preceded by preparatory meetings between the Chairman of the committee, the interim Chief People Officer and, where applicable, the Chief Executive Officer.

Composition and operation of the Board of directors and the various committees

- -Review of the Board's composition, independence and of its members’ key competencies

- -Follow up of improvement orientations suggested by the Board’s external assessment

- -Validation of the Board’s committees composition

- -Appointment process of the Board members

- -Chairman and Chief Executive Officer succession plan

Executive directors

- -Remuneration of the Chairman

- -Remuneration of the Chief Executive Officer, in particular the objectives of the variable portion, the evaluation of the achievement of the 2021 objectives

- -Review of long-term remuneration plans (free shares grant)

- -Directors’ remuneration policy

- -Group bonus objectives for the year 2022

- -Additional pension of the Chief Executive Officer

- -Definition of the objectives and modification of the duration of the Chief Executive Officer’s severance fee

- -Exceptional remuneration of the Chief Executive Officer

- -Salary policy for executives – Steering tables

Miscellaneous

- -Information on Quadient working style evolution, Work From Anywhere program

- -Information on Parcel Locker organisation and its HR challenges

- -Information on the “Customer Experience management” organisation and its HR issues

- -Information on the digitization of the corporate culture and the employee experience

- ●Appointments and remuneration committee:

-

2.3Remuneration report

2.3.12022 Remuneration paid to the directors and corporate officers

The total remuneration and benefits in kind paid by Quadient S.A. and the companies it controls to the directors, Didier Lamouche, Chairman and Geoffrey Godet, Chief Executive Officer, during the financial year 2022, which ended 31 January 2023, were awarded based on the resolutions approved by the General Meeting of 16 June 2022. These resolutions approved the principles and criteria for setting, allocating and awarding the various elements of this remuneration.

At Quadient, the remuneration policy for the executive director is determined by the Board of directors, upon the Appointments and remuneration committee’s proposal.

The Board of directors and the Appointments and remuneration committee refer to the recommendations of the Afep-Medef code when establishing the remuneration and benefits awarded to Quadient’s executive directors. In accordance with these recommendations, they ensure that the remuneration policy complies with principles of comprehensiveness, balance, comparability, consistency, transparency, and moderation, also considering market practices and, more generally, Quadient’s corporate interest.

2.3.1.1 2022 Remuneration paid to the directors

(In euros)

31 January 2023

31 January 2022

Remuneration of directors

Martha Bejar

58,500

58,500

Hélène Boulet-Supau

51,500

51,500

Éric Courteille

52,500

53,500

Virginie Fauvel

0

10,333

William Hoover Jr.

0

16,460

Christophe Liaudon, employee representing director

31,500

31,500

Nathalie Labia, employee representing director

31,500

31,500

Vincent Mercier

56,500

73,500

Richard Troksa

52,500

63,500

Nathalie Wright

38,833

41,500

Sébastien Marotte

31,500

10,500

Paula Felstead

41,500

8,584

Total compensation of non-executive directors

446,333

450,877

Other remuneration

-

-

Chairman remuneration as a director

30,000

30,000

Chief Executive Officer’s remuneration of director

30,000

30,000

Total remuneration of non-executive directors, Chairman and Chief Executive Officer

506,333

510,877

Maximum amount authorized by the General Meeting

555,000

560,000

In relation to their respective mandate as a director, the Chairman of the Board and the Chief Executive Officer receive a fixed amount of 30,000 euros per year for 100% attendance. The Chairman and Chief Executive Officer each regularly attend regular and ad hoc committee meetings as part of their mandates, and for ad hoc committees each of them have declined additional compensation for their attendance.

2.3.1.22022 Remuneration paid to the Chairman of the Board and to the Chief Executive Officer

Overview

The total remuneration and benefits in kind paid and owed by the Quadient S.A. and the companies it controls to Didier Lamouche during the financial year 2022, which ended on 31 January 2023, is allocated as follows:

Overview of the components of Didier Lamouche’s remuneration in his capacity as Chairman

(ln thousands of euros)

Paid or due as of

31 January 2023Fixed remuneration

120.0

Annual variable remuneration

-

Multiannual variable remuneration

-

Remuneration as director

30.0

Benefits in kind (company car, unemployment insurance for business directors)

-

Exceptional remuneration

-

Remuneration linked to the assumption or termination of duties

-

Valuation of performance shares granted during the financial year

-

The total remuneration and benefits in kind paid and owed by Quadient S.A. and the companies that it controls to Geoffrey Godet during the fiscal year 2022, which ended on 31 January 2023, is allocated as follows:

Overview of the components of Geoffrey Godet’s remuneration in his capacity as Chief Executive Officer

(ln thousands of euros)

Paid or due as

of 31 January 2023Annual fixed remuneration(a)

paid: 649.3

due: 650.0

Annual variable remuneration

paid: 708.8

due: 318.8

Multiannual variable remuneration

-

Compensation of directors

30.0

Benefits in kind (company car, unemployment insurance for business directors, supplementary retirement plan paid in cash)

paid: 195.6

due: 110.6

Compensation linked to the assumption or termination of duties

-

Valuation of performance shares awarded during the financial year

531.0

(a) The fixed remuneration is divided in two parts: 487,500 euros paid in France and 193,375 United States dollars paid in the United States. The EUR/USD exchange rate used is the budget rate, i.e. 1. 19 for the financial year 2022.

(a) Excluding supplemental pension scheme and benefits in kind that amounted to 110,612 euros for the fiscal year 2022

Pursuant to article L.22-10-8 of the French commercial code, it is hereby specified that the payment of variable components to Geoffrey Godet for the financial year 2022 shall be subject to approval of the General Meeting called to vote on the financial statements for the financial year which ended on 31 January 2023.

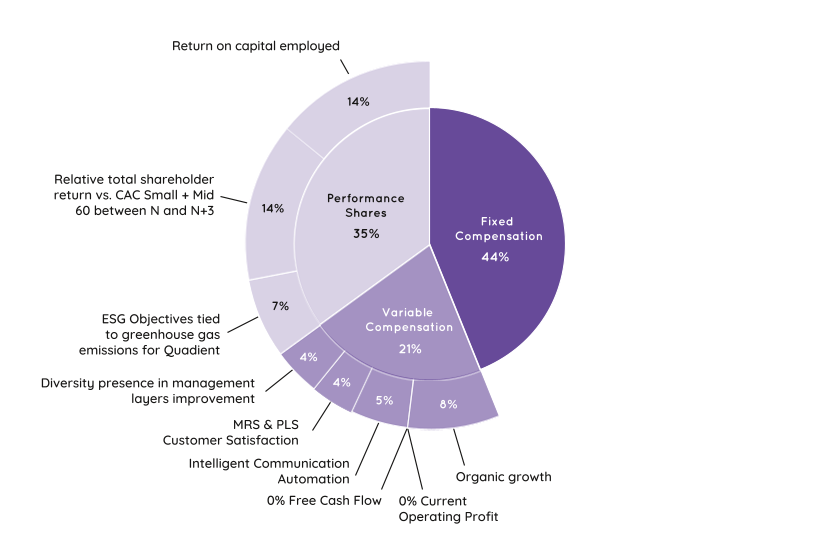

The Chief Executive Officer’s 2022 Annual Variable Remuneration

The Chief Executive Officer’s annual variable remuneration for 2022 is dependent on the Group’s results as well as his individual performance. CEO’s objective weighting is based on quantitative financial criteria for 70% of the target bonus, supplemented by qualitative individual performance objectives for the remaining 30%.

As illustrated below, the Chief Executive Officer's bonus achievement for the fiscal year 2022 stands at 49.1% and his annual variable remuneration for 2022 amounts to 239,122 euros paid in France and 94,852 United States dollars, subject to approval of the General Meeting to be held on 16 June 2023.

Targets have been restated from the ones set up at the start of the year to account for inorganic and un-budgeted divestments of the Shipping and Graphics activities, the change in IFRIC accounting and the cease of activities with Russian businesses.

(In thousands of euros)

Weight

Criteria

Threshold

(0.0%)

Target

(100%)

Maximum

(150%)

30%

Revenue

991.0

1,032.3

1,053.9

30%

Current Operating Profit(a)

137.8

146.6

152.5

10%

Free Cash Flow(b)

78.1

86.8

104.2

(a) Before acquisition related expenses, excluding innovation expense and assuming a constant scope.

(b) Cash flow after capital expenditure.

The achievements for the fiscal year 2022 of the quantitative criteria of the Chief Executive Officer's bonus, at the 2021 exchange rate, are the following:

(In thousands of euros)

Weight

Criteria

Performance

Bonus Achievement

30%

Revenue

1,017.3

63.5%

30%

Current Operating Profit(a)

133.7

0%

10%

Free Cash Flow(b)

70.3

0%

Total

19.1 %

(a) Before acquisition related expenses, excluding innovation expenses and assuming a constant scope.

(b) Cash flow after capital expenditure.

In addition, the Appointments and remuneration committee estimated that the individual (qualitative) performance objectives’ achievement rate was 100% compared to a maximum 150%.

For the 2022 financial year, the performance relating to the qualitative objectives assigned to Geoffrey Godet were as follows:

- ●10% tied to Intelligent Communication Automation (ICA): create and develop a mature ICA organization which encompasses R&D organization transformation into a global integrated team with operational synergies and a standard set of key performance indicators (KPIs), a solution portfolio vision and successful acquisitions integration.

- ●During 2022, ICA went through a major reorganization, integrating fully the R&D team, together with the product management team within the solution. YayPay and Beanworks teams were also included to his transformation in order to create a unique ICA global platform bringing together all of Quadient's software offerings. Synergies have emerged thanks to the streamlining of R&D, with a global platform architecture, a single roadmap defined with shared components, documentation etc. ICA has been showing strong progresses following this reorganization with a consolidated product launch roadmap with key milestones met according to schedule. Consequently, the Appointments and remuneration committee recommended that the performance was deemed achieved at 102.0%.

- ●10% tied to Mail-Related Solutions and Parcel Locker Solutions: maintain MRS customer satisfaction at 97%. The threshold is set at 95% and the maximum would be triggered at 98%. Maintain PLS customer satisfaction at 77%. The threshold is set at 75% and the maximum would be triggered at 80%.

- MRS customer satisfaction has reached 97% and PLS customer satisfaction has reached 78%. The performance is achieved at 100.6%.

- ●10% tied to an improvement in diversity presence for management layers: the ratio of women in the senior leader and executive committee population should be increased to 24%. The threshold is set at 23% and the maximum would be triggered at 26%. The calculation will be triggered only if there is a minimum of 28% of women among directors and middle management layers by the end of fiscal year 2022.

- The ratio of women amongst directors and middle management by the end of fiscal year 2022 is 28.3%. The ratio of women in the Senior Leaders and the Executive Committee by the end of fiscal year 2022 is 23.4%. The performance is achieved at 97.3%.

The Chief Executive Officer’s 2022 supplemental pension scheme

In addition to the defined-contribution supplemental pension scheme (article 83 of the French general tax code) the Board of directors, on the recommendation of the Appointments and remuneration committee and in accordance with the resolutions of the General Meeting of 16 June 2022, approved the principle of granting the Chief Executive Officer a supplemental pension scheme. This scheme is based on payments made in cash that will represent 15% of his theoretical annual fixed and variable remuneration assuming objectives are met at 100%, such payments will be degressive in proportion to the achievement of such performance objectives. The percentage of achievement relating to the annual variable compensation of the Chief Executive Officer therefore applies to these payments, but would be capped at 100% of the objectives achieved.

On the recommendation of the Appointments and remuneration committee, the Board of directors, which determined the variable remuneration of the Chief Executive Officer based on performance for 2022, approved the payment of 71,737 euros to be paid in France and 28,456 United States dollars to be paid in the United States, in respect of this supplemental pension scheme, for the financial year 2022. Pursuant to article L.225-37-2, it is hereby specified that this payment shall be subject to the approval of the General Meeting called to vote on the financial statements for the financial year which ended on 31 January 2023.

- ❚Table # 1 Afep-Medef code: Table summarising the compensation, options and shares awarded to each executive officer

(In thousands of euros)

31 January 2023

31 January 2022

Didier Lamouche

Remuneration due for the fiscal year

150.0

150.0

Valuation of multiannual variable remuneration awarded during the fiscal year

-

-

Valuation of options awarded during the fiscal year

-

-

Valuation of long term incentive plans awarded during the fiscal year

-

-

Total

150.0

150.0

(In thousands of euros)

31 January 2023

31 January 2022

Geoffrey Godet – Chief Executive Officer

Remuneration due for the fiscal year

1,109.4

1,523.6

Valuation of multiannual variable remuneration awarded during the fiscal year

-

-

Valuation of options awarded during the fiscal year

-

-

Valuation of long term incentive plans awarded during the fiscal year

531.0

492.2

Total(a)

1,640.4

2,015.8

(A) The 2022 fixed remuneration is divided in two parts: 487,500 euros paid in France and 193,375 United States dollars paid in the United States. The exchange rate EUR/USD used is the budget rate, 1. 19 for financial year 2022 and 1.24 for financial year 2021.

(In thousands of euros)

31 January 2023

31 January 2022

Amounts due

Amounts paid

Amounts due

Amounts paid

Didier Lamouche - Chairman

Annual fixed remuneration

120.0

120.0

120.0

120.0

Annual variable remuneration

-

-

-

-

Multiannual variable remuneration

-

-

-

-

Remuneration as director

30.0

30.0

30.0

30.0

Benefits in kind

-

-

-

-

Total

150.0

150.0

150.0

150.0

Geoffrey Godet – Chief Executive Officer

Annual fixed remuneration(a)

650.0

649.3

596.3

590.9

Annual variable remuneration(b)

318.8

708.8

701.8

-

Multiannual variable remuneration

-

-

-

-

Remuneration as director

30.0

30.0

30.0

30.0

Benefits in kind

110.6

195.6

195.5

16.6

Exceptional remuneration(c)

-

-

-

240.1

Total

1,109.4

1,583.7

1,523.6

877.6

The exchange rate used is the budget rate, 1. 19 for financial year 2022 and 1.24 for financial year 2021.

(a) The 2022 fixed remuneration is divided in two parts: 487,500 euros paid in France and 193,375 US dollars paid in the United States.

(b) The 2022 variable remuneration is divided in two parts: 239,122 euros paid in France and 94,852 US dollars paid in the United States.

(c) The exceptional remuneration is divided in two parts: 204,000 euros paid in France and 44,800 US dollars paid in the United States.

- ❚Table # 4 Afep-Medef code: Subscription or purchase options awarded during the fiscal year to each executive officer by the issuer and by any group company

- ❚Table # 5 Afep-Medef code: Subscription or purchase options exercised during the financial year by each executive officer

- ❚Table # 6 Afep-Medef code: Performance shares awarded during the financial year to each executive officer by the issuer and by any group company

(In thousands of euros)

Number and date of plan

Number

of shares granted

during

the yearValuation of shares(a)

Vesting date

Availability date

Performance criteria

Didier Lamouche – Chairman

-

-

-

-

-

-

Geoffrey Godet – Chief Executive Officer

Performance share plan

01/09/2022

46,000(b)

464.1

02/09/2025

02/09/2025

ROCE(c)

RTSR(d)

GHG(e)

Geoffrey Godet – Chief Executive Officer

Phantom share plan

23/09/2022

8,267

66.8

24/09/2025

24/09/2025

ROCE(c)

RTSR(d)

GHG(e)

(a) IFRS valuation standards.

(b) i.e 0. 13% of the share capital.

(c) Return on capital employed

(d) Relative total shareholder return vs. CAC Small + Mid 60 between 2022 and 2024 share price on the acquisition date, less the opening Quadient share price on the attribution date, plus any dividends paid during the period concerned, divided by the opening Quadient share price on the attribution date and compared to the average Total Shareholder Return ratio, (calculated in the same manner) of the CAC Small + Mid 60 index companies.; The performance is measured at the end of the 3 years on the basis of the average TSR of the February month of year 2022 and (ii) the January month of year 2025, in order to determine the percentile of Quadient within the CAC Small + Mid 60 index during this one-year period.

(e) Greenhouse Gas Emission targets for Quadient

As per 2023 policy, the Board of directors used the provision allowing the grant of phantom shares to the Chief Executive Officer as the company share price was not high enough to guarantee a grant of 135% of his base salary, while remaining within the limitation of 10% of the total number of free shares allocated annually. To determine the number of phantom shares to be granted, the Company used the average closing share price of the month preceding the Board of directors that approved the plan, which occurred on 23 September 2022. The vesting of the phantom shares is subject to the same conditions as the performance shares.

- ❚Table # 7 Afep-Medef code: Performance shares that have become available during the financial year for each executive officer

2.3.1.3 2022 Comparison of compensation levels between corporate officers and employees

Management team members

The management team is composed of the leaders from each support function, along with the business leaders within each solution and each operation by geographic region.

During the fiscal year 2022, Quadient continued the evolution of its management team as part of the streamlining of its organisation. The Group now relies on more international and specialized profiles.

On 1 February 2022, the management team, together with the Chief Executive Officer, were as follows:

Geoffrey Godet

Chief Executive Officer

Support functions

Stéphanie Auchabie (a)

Chief People Officer

Brandon Batt

Chief Transformation Officer

Laurent du Passage

Chief Financial Officer

Steve Rakoczy

Chief Digital Officer

Tamir Sigal

Chief Marketing Officer

Solutions

Alain Fairise

Mail-Related Solutions

Chris Hartigan

Intelligent Communication Automation

Daniel Malouf

Parcel Locker Solutions (b)

Zbynek Hodic (c)

Software Technology

Thierry Le Jaoudour (d)

Hardware Technology

Operations

Benoît Berson (b)

France and Benelux (a)

Duncan Groom

Germany, Austria, Switzerland & Italy and United Kingdom & Ireland

Ian Clarke

International

(a) Stéphanie Auchabie was appointed COO France-Benelux in June 2022. Consequently, Brandon Batt was appointed interim Chief People Officer.

(b) Benoît Berson was appointed Head of the Parcel Lockers Solutions in June 2022. He has succeeded Daniel Malouf who has left the Group.

(c) In July 2022, Zbynek Hodic was appointed Chief Technology Officer of ICA, reporting to Chris Hartigan. He is no longer part of the management team.

(d) In July 2022, Thierry Le Jaoudour was appointed Chief Technology and Supply Chain Officer of PLS, reporting to Benoît Berson. He is no longer part of the management team.

The key task of the management team is to help execute the Company’s strategic decisions and coordinate their implementation worldwide.

To achieve the objectives it has set, Quadient has invested and will continue to invest in diversity and improving gender parity, when looking at the representation of women in the Board of directors, in executive management and in the management team, and by creating a positive environment not only for its women employees, but also for people of diverse backgrounds.

Quadient's Chief Executive Officer and executive team members all have diversity and inclusion targets in their annual variable bonus qualitative objectives.

As a reference, Quadient launched its inclusion and diversity policy on 23 October 2020. More information can be found here : https://careers.Quadient.com/global/en/diversity-and-inclusion.

- Create an environment of openness allowing all employees to bring their whole selves to work and grow a sense of belonging. Quadient does not discriminate against any individual because of their age, gender identity or reassignment, marital or civil partnership status, pregnancy, paternity, maternity, parental or family status, race or ethnicity, nationality or national origin, colour, religion, disability status, sex or sexual orientation, veteran status, political affiliation, language, genetic information (including family medical history), or any other dimension of diversity. The Company embraces and encourages its employees' differences and all employees will be treated fairly and with respect;

- Build diverse talent and teams by attracting, recruiting and hiring from diverse talent pools to enrich the organization;

- Embed inclusion and diversity practices into all our talent practices to ensure that the Company has a global workforce of talent to grow our leadership pipeline across the globe;

- Set up empowered Communities to support an inclusive culture and offer a sense of community and connection among employees; and to support diversity initiatives in Quadient’s external community through its philanthropy program;

- Promote awareness and understanding amongst all employees thereby developing an educated workforce on inclusion and diversity; and

- Set measurable objectives for diversity and inclusion which will be monitored and reviewed against the effectiveness of this policy and associated procedures.

- ●to address gender diversity in leadership: the Company continues to invest in a women’s leadership program. This program is called “Empower” and is supported by Geoffrey Godet and Quadient’s management team. It is designed to deliver practical insights and skills focused on both the challenges and opportunities for women in leadership. The program provides participants with opportunities to reflect, reframe and retool, build a powerful learning network and in turn, empower other women to be a part of their success story.

- ●to create an inclusive environment: Quadient has launched employee network groups, named Empowered Communities which are employee-led and promote opportunities for members and allies to network, learn together and share experiences in a safe psychological space with 4 main focuses: women, LGBT+, disabilities, ethnicity & cultural background;

- ●Quadient has also decided to take an active part in events dedicated to women’s rights, which help to develop the awareness of employees on this subject. Training for both managers and employees are available and promoted to help them fight against unconscious bias;

- ●to accelerate the acquisition of talents from diverse backgrounds, Quadient has launched specific recruitment campaigns with the aim of diversifying the profiles recruited within the Company.

- ●Executive committee leaders have diversity targets included in their annual goals.

Pay ratio

This presentation was made in accordance with the terms of article L.22-10-9 of the French commercial code.

The ratios below have been calculated on the basis of fixed and variable remuneration, incentive schemes, profit-sharing and benefits in kind paid during the years in question, as well as free shares awarded during the same period and valued according to their fair value.

The calculation of averages and medians considers 1,168 employees for the 2022 fiscal year, excluding executive directors. This scope covers employees who have been continuously compensated by one of Quadient’s French entities and who were present for the entire fiscal year in question.

PAy ratio 2022

31 January

202331 January

202231 January

202131 January

202031 January

2019Chairman of the Board of directors

Ratio of Chairman’s remuneration/average employee remuneration

2.4

2.4

2.4

2.4

2.8

Ratio of Chairman’s remuneration/median employee remuneration

3.0

3.1

3.1

3.0

2.8

Chief Executive Officer

Ratio of Chief Executive Officer’s remuneration/average employee remuneration

34.4

22.1

30.5

29.7

16.7

Ratio of Chief Executive Officer’s remuneration/median employee remuneration

42.6

28.1

38.2

37.4

21.0

Employees of Quadient

Change in average employee remuneration

(0.8)%

+0.7%

(2.8)%

+6.3%

n/a

Change in median employee remuneration

+1.8%

(0.8)%

(2.8)%

+4,8%

n/a

Financial performance of Quadient

Change in revenue

+5.6%

(0.5)%

(9.9)%

+4.7%

(1.8)%

Change in current operating income

+3.5%

+2.3%

(17.1)%

(7.1)%

(1.5)%

The decrease in the ratios relating to the remuneration of the Chief Executive Officer between 2020 and 2021 is due to the fact that Geoffrey Godet waived his variable remuneration and supplemental scheme for the year 2020. Consequently, as the table is based on compensation paid during the year, no variable remuneration is accounted for in the calculation.

-

2.4Related-party agreements

In accordance with article L.22-10-12 of the French commercial code, the Board of directors has implemented a procedure to regularly assess whether the agreements relating to day-to-day operations and entered into under the normal conditions referred to in article L. 225-39 met these conditions. The Board of directors carries out, when necessary, the assessment of agreements entered into under normal terms and conditions to ensure that they continue to meet these conditions.

The Board of directors is informed of any draft agreement likely to constitute a related party agreement or a so-called free agreement and of its evaluation by the competent management, for qualification purposes. When a member of the Board of directors has a direct or indirect interest in the agreement, he or she does not take part in its evaluation.

-

2.5Summary table of the current General Meeting delegations of powers to the Board of directors and indicating the use made of these delegations during the 2022 fiscal year (article L.225-37-4,3° of the French commercial code)

Authorizations

Date of the General Shareholders' Meeting resolution

Term

Use during 2022 fiscal year which ended 31 January 2023

Share buyback program - to proceed, directly or indirectly, on one or more occasions which it shall decide, to buy back shares up to a maximum of 10% of the total number of shares comprising the share capital, with the option to sub-delegate. The maximum purchase price may not exceed €50.

16 June 2022

18 months

used

Issue ordinary shares and securities giving access to the Company’s share capital, with the maintenance of the shareholders’ preferential subscription rights

16 June 2022

26 months

not used

Issue ordinary shares, with the removal of the shareholders’ preferential subscription rights through public offering (excluding an offer referred to in 1, article L.411-2 of the French monetary and financial code)

16 June 2022

26 months

not used

Issue ordinary shares, with the removal of the preferential subscription rights through an offer referred to in 1, article L.411-2 of the French monetary and financial code

16 June 2022

26 months

not used

Issue securities giving access to the Company’s share capital, with the removal of the shareholders’ preferential subscription rights through public offering (excluding an offer referred to in 1, article L.411-2 of the French monetary and financial code)

16 June 2022

26 months

not used

Issue securities giving access to the Company’s share capital, with the removal of the shareholders’ preferential subscription rights through an offer referred to in 1 of article L.411-2 of the French monetary and financial code

16 June 2022

26 months

not used

Increase the amount of shares issued in the event of over subscription to ordinary shares or securities giving access to the Company’s share capital

16 June 2022

26 months

not used

Increase share capital by incorporation of reserves, profits or premiums

16 June 2022

26 months

not used

Increase the share capital by issuing new ordinary shares and securities giving access to the Company’s share capital in return for contributions in kind within a limit of 10% of the share capital

16 June 2022

26 months

not used

Issue ordinary shares and securities giving access to the Company’s share capital, in the event of a public exchange offer initiated by the Company

16 June 2022

26 months

not used

Proceed with share capital increases and sales of shares reserved to members of a company or Group savings plan in application of article L.3332-1 and subsequent sections of the French labour code

16 June 2022

26 months

not used

Proceed with share capital increases reserved to employees and corporate officers of foreign subsidiaries or branches who cannot subscribe, directly or indirectly, to the Company’s shares under the previous resolution, and for all financial institutions or companies created specifically and exclusively to implement an employee savings scheme for employees (or former employees) of foreign subsidiaries or branches who cannot subscribe, directly or indirectly, to the Company’s shares under the previous resolution

16 June 2022

18 months

not used

Proceed with allocation of existing performance shares or performance shares to be issued with the removal of the shareholders’ preferential subscription rights

16 June 2022

14 months

not used

Cancel shares acquired pursuant to the Company’s share buyback program

16 June 2022

18 months

Capital reduction corresponding to the cancellation of 94,000 shares (Board meeting of 2 December 2022)

Only the authorizations relating to the Company's share buyback program and to cancel shares acquired pursuant to the Company’s share buyback program were used during the financial year 2022.

The full wording of these authorizations is available on request from Quadient head office. The General Shareholder Meeting of Quadient called on 16 June 2023 to vote on the financial statements for the financial year that ended on 31 January 2023 will be asked to renew these authorizations on similar terms.

-

2.6Information that could have an impact in the event of a takeover bid or exchange offer

In accordance with the provisions of article L.22-10-11 of the French commercial code, the factors that could have an impact on a takeover bid are the following:

- ●the Company’s capital structure as described in section 7 of the universal registration document;

- ●direct or indirect investments in the Company’s capital known to the Company pursuant to articles L.233-7 and L.233-12 of the French commercial code, as described in section 3 of the universal registration document;

- ●the rules applicable to the appointment and replacement of members of the Board of directors and amendments to the Company’s articles of association, which are decided by General shareholders’ Meetings;

- ●the Board of directors’ powers as delegated by the General shareholders’ Meeting, particularly those relating to the issue or buy-back of shares, as described in section 2.5 of the universal registration document.

-

2.7Practical information for attending the General Meeting

Pursuant to applicable law, the particular modalities relating to the participation of shareholders in the General Meeting are set out in the articles of association, available on the Company’s website. The notice of meeting including the draft agenda and proposed resolutions will be published in the Bulletin des Annonces Légales Obligatoires (BALO) and on the Company’s website.

All shareholders may participate in the General Meeting, regardless of the number of shares they own, notwithstanding any provisions to the contrary provided for by the articles of association.

The right of shareholders to participate in the General Meeting is conditional on their shares being registered in their name, or in the name of the intermediary acting on their behalf pursuant to paragraph 7 of article L.228-1 and article R.22-10-28 I. of the French commercial code, no later than 00:00, Paris time, on the second business day prior to the General Meeting, i.e. 14 June 2023, either in the registered share accounts held by the Company or in the bearer share accounts kept by the authorized intermediary.

Registration of the shares in bearer share accounts kept by authorized intermediaries must be evidenced by a certificate of participation issued by such intermediaries, or can be transmitted electronically if applicable under article R.225-61 of the French commercial code. This certificate of participation must be attached to the voting form or the proxy form, or to the request for an admission card in the shareholder’s name or that of the broker that manages the share account. Shareholders wishing to attend the Meeting in person and who have not received their requested admission card by 00:00, Paris time, two working days prior to the General Meeting will also be issued a certificate. If shareholders do not wish to attend the General Meeting in person, they may choose one of the following three options:

1. send a proxy vote to the Company without specifying a proxy holder. All proxy votes granted without a specified proxy shall result in a vote for the approval of the draft resolutions presented or accepted by the Board of directors and a vote against all other draft resolutions;

2. authorize a proxy vote by their spouse or partner with whom they have entered into a civil union or a shareholder or any other natural or legal person of their choosing, in accordance with article L.22-10-40 of the French commercial code. Duly completed and signed proxy forms must include the full name and address of the shareholder and their proxy and be mailed along with a photocopy of the shareholder’s ID and that of their proxy to Uptevia. The same formalities that apply for granting a proxy apply for withdrawing it.

In accordance with the provisions of article R.22-10-24 of the French commercial code, notifications to appoint a proxy holder or withdraw a proxy may also be sent electronically, as follows:

- ●for registered shareholders: by sending an email with an electronic signature obtained from an accredited certification service provider to: ct-mandataires-assemblees@uptevia.com, indicating their full name, address and Uptevia ID for direct registered share (information printed in the top left-hand corner of share account statements), or indicate their ID with their bank or broker if the case administered registered shares, as well as the full name of the designated proxy holder or the person from whom the proxy is being withdrawn;

- ●for bearer shareholders: by sending an email with an electronic signature obtained from an accredited certification service provider to: ct-mandataires-assemblees@uptevia.com, indicating their full name, address and full bank details, and the full name of the designated proxy holder or the person from whom the proxy is being withdrawn, and by asking their bank or broker managing the share account to send a written confirmation (by letter) to Uptevia – Service Assemblée Générale – 12, Place des Etats-Unis, CS 40083, 92549 Montrouge cedex.

Only duly completed and signed notifications received three days prior to the General Meeting at the latest will be taken into account. In addition, only the aforementioned email address may be used to send notifications to appoint or withdraw proxies; requests or notifications concerning other matters will not be taken into account and/or processed.

Shareholders who have cast a postal vote, appointed a proxy or requested an admission card or share ownership certificate may still sell all or some of their shares at any time. However, if the sale takes place more than two business days prior to the General Meeting, namely 14 June 2023, 00:00, Paris time, the Company will take the appropriate measures to cancel or amend the related postal vote, proxy, admission card or share ownership certificate. The shareholder’s bank or authorized intermediary must therefore notify the Company or its registrar of any such sale and provide it with the necessary information.

No sale or other transactions carried out after the second business day prior to the General Meeting, at 00:00, Paris time, irrespective of the method used, will be notified by the authorized intermediary or taken into account by the Company, notwithstanding any agreements to the contrary.

Postal voting forms or proxy forms will be automatically sent by mail to the holders of direct or administered registered shares.

Pursuant to the applicable laws and regulations, all documents that must be made available to shareholders for the purpose of this General Meeting, may be consulted, within the legally prescribed time frames, at the Quadient S.A. head office and on the Company’s website https://invest.quadient.com/assemblees-generales or sent on written request to Uptevia.

Bearer shareholders should request a postal/proxy voting form by way of a letter, which must be received by registered mail with acknowledgement of receipt by Uptevia – Service Assemblée Générale – 12, Place des Etats-Unis, CS 40083, 92549 Montrouge cedex at least six days prior to the General Meeting.

In order for postal votes to be taken into account, the completed and duly signed postal voting forms must be sent to Uptevia – Service Assemblée Générale – 12, Place des Etats-Unis, CS 40083, 92549 Montrouge cedex at least three days prior to the General Meeting.

Shareholders who have cast a postal vote, appointed a proxy or requested an admission card or share ownership certificate will not be able to participate in the General Meeting in any other way, unless the articles of association provide otherwise.

Shareholders may submit written questions to the Company as from the publication date of this Notice. Any such questions must be sent to the Company’s head office by registered mail with acknowledgement of receipt by the fourth business day prior to the date of the General Meeting. A share registration certificate must be attached to the letter. The Board of directors is required to reply to these questions during the General Meeting and a joint response can be given to questions that have the same content. Answers to the questions will be posted on the Company’s website at the following address:

https://invest.quadient.com/assemblees-generales.Shareholders that meet applicable legal conditions may submit items or draft resolutions for the agenda of the General Meeting by sending a request by registered mail with acknowledgement of receipt, to be received at least 25 calendar days prior to the date of the General Meeting. A share registration certificate must be sent with any such request, evidencing that the applicant holds or represents at least 5% of the Company’s capital.

Any draft resolutions proposed by shareholders, as well as a list of any items that have been included in the agenda of the General Meeting further to a shareholder’s request, will be published on the Company’s website: https://invest.quadient.com/assemblees-generales

In addition, review by the General Meeting of any items or draft resolutions submitted is conditional on the relevant parties providing, on the second business day prior to the date of the General Meeting, no later than 00:00, Paris time, a new certificate evidencing that their shares are registered in accordance with the requirements specified above.

-

2.8Statutory auditors’ report on related party agreements

Annual General Meeting held to approve the financial statements for the financial year ended 31 January 2023.

In our capacity as statutory auditors of your Company, we hereby present to you our report on related party agreements.

On the basis of information made available to us, we are responsible for communicating to you the characteristics and essential terms of, and the grounds supporting the Company’s interest in, the agreements of which we have been informed of or that we discovered during our assignment, without having to express our own opinion on their utility or appropriateness or being required to seek whether other agreements and commitments exist. Pursuant to article R.225-31 of the French commercial code (Code de commerce), you are responsible for assessing the interest in entering into these agreements and commitments in view of their approval.

In addition, we are responsible for communicating to you the information contemplated by article R.225-31 of the French commercial code (Code de commerce) relating to the performance over the period under review of the agreements already approved by the Annual General Meeting.

We carried out the procedures which we deemed necessary in compliance with the professional standards of the French Institute of statutory auditors (Compagnie nationale des Commissaires aux comptes) relating to this type of engagement.

1.Agreements submitted for approval to the Annual General Meeting

-

3. Management report

-

3.1Review of Quadient’s financial position and results in 2022

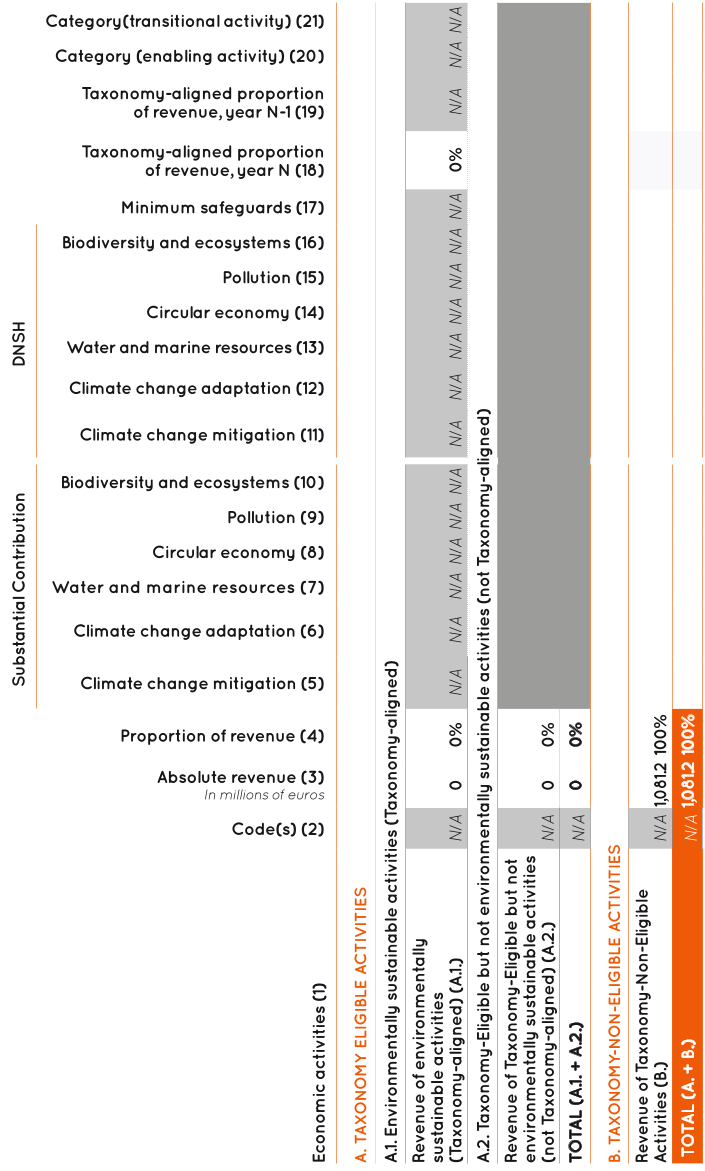

For the full-year 2022, consolidated sales amounted to 1,081.2 million euros, up 5.6% compared to the full-year 2021. Organic change stood at 1.4%(1) for the period. Subscription-related revenue (69% of the Group’s total sales) recorded an organic growth of 3.1% in 2022 compared to 2021.

Current operating income(2) amounted to 150.0 million euros in 2022 compared to 146.8 million euros in 2021.

Net attributable income amounted to 13.3 million euros in 2022 compared to 87.8 million euros in 2021.

The net margin(3) stood at 1.2% of sales in 2022 compared to 8.6% in 2021.

Cash flow after capital expenditure amounted to 70.3 million euros in 2022 compared to 104.1 million euros in 2021.

3.1.1Highlights

Quadient Launches its Accounts Payable Automation Solution Beanworks in France and the UK Amidst Rising Demand

On 16 February 2022, Quadient announced the launch of Beanworks by Quadient in the United Kingdom (UK) and France. The leading accounts payable (AP) automation solution provides accounting teams with a faster, more secure and easier way to approve invoices and pay vendors from anywhere.

Purolator Installs Parcel Pending by Quadient Smart Lockers to Enhance Customer Experience and Meet Increased Package Delivery Demands

On 22 February 2022, Quadient announced that Purolator, one of Canada’s leading integrated freight, package and logistics solutions providers, has installed more than 20 Parcel Pending by Quadient smart locker systems at its busiest terminals in Canada. The automated smart lockers provide Purolator’s customers with a convenient and secure way to retrieve their packages, any time, day or night.

Quadient Continues Footprint Expansion in Document Automation Cloud Solutions with Impress Distribute now Available in Germany

On 12 April 2022, Quadient announced the launch of Impress Distribute in Germany, expanding in yet another major European market the capabilities of Quadient® Impress, its cloud-based document automation for small and medium businesses (SMBs). With Impress Distribute, Quadient now brings additional communication channels to German users, in particular print mail outsourcing in partnership with SPS, a global full-service provider of business process services.

Quadient and Decathlon Reaffirm Partnership on Parcel Lockers

On 3 May 2022, Quadient announced that Decathlon, a leading global sporting goods retailer, will equip dozens of additional stores with Quadient’s automated parcel lockers in 2022. Since the adoption of the first Quadient locker solutions in 2015, Decathlon has equipped 62 stores in France with the lockers. The success of the lockers, which has been tested and certified by the retailer’s teams, motivated the sports brand to expand its partnership with Quadient. New consumer consumption patterns and growing demand for more convenient delivery solutions, accelerated by the global pandemic, led Decathlon to refine its omnichannel strategy by increasing the pick-up options for its “click & collect” offers.

Quadient Launches Automated Accounts Receivable Solution YayPay in France

On 10 May 2022, Quadient announced the launch in France of YayPay by Quadient, a cloud-based intelligent account receivable (AR) solution that automates the entire AR process from credit to cash application. The YayPay expansion comes on the heels of the launch earlier this year of Quadient’s accounts payable (AP) automation solution, Beanworks, in France and the United Kingdom, as well as last month’s launch of Impress Distribute, its cloud-based omnichannel document distribution solution, in Germany. Powered by artificial intelligence and machine learning, YayPay’s predictive analytics engine provides insights on payer behavior and their impact on cash flow, with the use of dynamic dashboards and process automation that help to reduce outstanding receivables and day sales outstanding (DSO) for companies.

Quadient Named a Leader in IDC MarketScape for Cloud Customer Communications Management

On 2 June 2022, Quadient announced that Quadient was named a leader in the IDC MarketScape: Worldwide Cloud Customer Communications Management Applications 2022 Vendor Assessment - Dynamic Delivery of Multi-channel Personalized Experiences (doc #US48167722, May 2022). The report provides details to assess providers of customer communication management (CCM) solutions, including Quadient Inspire and Quadient Impress. According to the IDC MarketScape report, enterprises that seek omni-channel customer experiences through the lens of a customer journey should consider Quadient. The IDC MarketScape listed customer experience strategy, performance and scale and implementation experience as strengths of Quadient.

Quadient Reaches Milestone of 12,000 Global Customers for Cloud Software Solutions

On 14 June 2022, Quadient confirms that the number of customers of its cloud software business has surpassed the 12,000 mark globally, with a net increase of about 450 in the first period of 2022. The growth in Quadient’s Intelligent Communication Automation (ICA) software business was fuelled by existing customers of Quadient’s mail equipment, who turned to the company’s cloud software solutions for digital transformation. Additional growth was driven by the deployment in France and the UK of Quadient’s recently acquired accounts payable automation software solution, Beanworks.

Quadient announces the sale of its Graphics activities in the Nordic countries to Ricoh

On 16 June 2022, Quadient announced the completion of the transaction for the divestment of its Graphics activities in the Nordic countries to the print company, Ricoh. As part of its ‘Back to Growth’ strategy, Quadient remains fully committed to accelerate the growth of its strategic software and parcel locker solutions, driven respectively by the acceleration of business processes digitalization and the growth of e-commerce. As a result, Quadient has been reshaping its portfolio by divesting non-core activities within its Additional Operations. Quadient’s Graphics business in the Nordic countries mainly consists in the distribution of printing and print finishing business solutions in Sweden, Norway, Denmark, and Finland.

Quadient rejoins the Euronext SBF 120 index

On 20 June 2022, Quadient announced that it has re-entered the Euronext SBF 120 and CAC Mid-60 indices in accordance with the decision taken by the Euronext Index Steering Committee. The integration took place on 17 June 2022 after market close and is effective from Monday 20 June 2022.

Quadient Announces Roll-out of a Large Parcel Locker Network Available to Carriers and Retailers Across the UK

On 24 June 2022, Quadient announced it will install carrier-agnostic parcel lockers at large scale in the UK. Over 500 parcel lockers this year, and 5,000 in the coming years, will be made available to all UK carriers and retailers to offer convenient parcel pickup and drop-off locations and an exceptional shopping experience to their customers, with a flexible choice of pickup times and locations. Quadient teams have ensured technical integration with the systems of key carriers in the UK and have secured hundreds of prime locations for locker units to quickly scale. Quadient’s ambition is to establish a dense, large and scalable network to consolidate first and last mile deliveries, especially in urban areas where there is medium to high delivery density. Having readily available open access to a large parcel delivery network alleviates the mounting pressure experienced by carriers and retailers to scale to increasing demand and parcel volumes.

Quadient announces completion of divestment series with the sale of its Shipping activity

On 30 June 2022, Quadient announced the sale of its Shipping solutions business. This activity, reported under the Additional Operations segment, includes a complete logistics and transport management solution, as well as the production, management, and distribution of RFID systems for asset tracking. The sale covers assets, industrial processes, and activities of the Shipping business, and is done through a management buyout (MBO). The revenue from the divested activities amounted to c. 5 million euros in 2021. Upon completion of this sale, forty Quadient employees will be transferred to the new entity.

Quadient Named a Leader in Journey Mapping by Independent Research Firm

On 6 July 2022, Quadient announced that the company has been named a Leader in The Forrester Wave™: Journey Mapping Platforms, Q2 2022. Forrester Wave reports provide an overview of the top providers in a market space with analysis of their current offerings and strategies. Forrester, an international research, and advisory firm, included 12 vendors in its journey mapping platforms assessment, with Quadient named as one of only three Leaders. Providers were evaluated against 25 criteria grouped into three categories: current offering, strategy, and market presence.

Acceleration of Quadient’s UK smart locker network adoption

On 22 July 2022, Quadient announced the first contracts signed with international carriers to use its new smart parcel locker network in the UK. Since the announcement end of June of the roll-out of the large network of Parcel Pending by Quadient smart lockers available to all carriers and retailers in the UK, global parcel delivery expert DPD UK confirmed it was the first major partner committing to utilize Quadient’s network to add more choice and convenience for its customers with parcel locker delivery. Quadient’s ambition is to implement the solution at 500 locations by the end of 2022, and 5,000 locations in the coming years. With the technical integration with DPD UK complete, DPD customers will start using Parcel Pending by Quadient smart lockers in the UK this month.

Following on from this first partnership, a second large international carrier has also committed to access Quadient’s Parcel Pending locker network. The signing of an additional carrier reinforces the strategic importance and attractiveness of a smart locker network for the automation of last-mile delivery in the world’s third-largest e-commerce market. Quadient expects to announce additional partnerships with carriers, as well as retailers, in the coming months.

Quadient Named as a Leader in the Aspire CCM-CXM Leaderboard for the Fifth Consecutive Year

On 26 July 2022, Quadient announced that it has been positioned as a Leader in the 2022 Aspire Leaderboard™ of customer communications management (CCM) and customer experience management (CXM) vendors. This is the fifth consecutive year Quadient has earned the distinction. Aspire, a leading international consulting firm specializing in CCM and CXM industries, features five interactive grids in its 2022 Leaderboard, placing vendors into categories to help identify the best solution to meet an organization’s current and future needs. Quadient is recognized as a Leader on both the AnyPrem CCM Software, and Vendor Hosted SaaS CCM grids, as well as a Leader in the grid for Communications Experience Platform (CXP).

Quadient in the Top 10 of the Truffle 100 Ranking of French Software Companies for the Fifth Year in a Row

On 4 August 2022, Quadient announced it has positioned 10th in the Truffle Top 100, a ranking of French software companies. The latest ranking marks the fifth consecutive year Quadient has placed in the top 10 of the Truffle 100, which is compiled by Truffle Capital and teknowlogy group|CXP-PAC. The ranking is based on the software revenue submitted by each participating company.

Quadient among Finalists for Reuters Events 13th Annual Responsible Business Awards

On 7 September 2022, Quadient announced the company has been named a finalist for the Reuters Events 13th Annual Responsible Business Awards, in the Diversity, Equity & Inclusion category.

The Responsible Business Awards recognize and celebrate leaders in sustainable businesses that are positively impacting society, business and the environment. The award program serves as a benchmark for companies from across the globe looking to showcase leadership against international peers.

Quadient Introduces the DS-700 iQ Next-generation, Flexible and Scalable Folder Inserter Solution

On 15 September 2022, Quadient announced the global launch of the DS-700 iQ, Quadient’s newest modular, flexible and scalable folder inserter solution. The DS-700 iQ is equipped with more than 30 enhancements designed to address the evolving workflow demands of today’s high-volume mailing environments.

DHL Parcel UK announces partnership with Quadient to offer smart locker delivery

On 21 September 2022, Quadient announced that DHL Parcel UK is joining its growing parcel locker network in the United Kingdom. DHL Parcel UK shared the announcement below:

DHL Parcel UK today announced a new partnership with Quadient to offer smart lockers parcel pick-up throughout the UK. The contactless, secure locker stations will give recipients more choice and flexibility to receive their parcels at a time and location that suits them. The deployment is underway to have 500 operating locker stations across the UK by the end of 2022, with plans for a further 5,000 in the coming years. Most installations will be outdoor facilities accessible 24 hours a day. [..]

Quadient Launches SaaS Electronic Invoice Presentment and Payment Solution for Small and Medium-Sized Businesses

On 5 October 2022, Quadient announced the release of Quadient Impress Invoice, a software-as-a-service (SaaS) that securely and compliantly automates the preparation and delivery of invoices. Impress Invoice features built-in electronic invoice presentment, invoice delivery and facilitates payment of those invoices, so businesses get paid faster while offering customers added convenience and improved satisfaction. Impress Invoice is available in the US and UK and will launch in France, Germany and other European countries by the end of the year.

Quadient Recognized for its Corporate Social Responsibility Program with a 2022 Tech Cares Award from TrustRadius

On 10 October 2022, Quadient announced that TrustRadius, the most trusted research and review platform, has recognized Quadient with a 2022 Tech Cares Award. This third-annual award celebrates companies that have gone above and beyond to provide impactful corporate social responsibility (CSR) programs for their employees and surrounding communities.

Quadient’s corporate social responsibility (CSR) strategy is built around five pillars: People, Solutions, Ethics & Compliance, Environment and Philanthropy. These pillars are aligned with the UN Global Compact principles that Quadient committed to respect, support and promote by joining the initiative in 2021. Becoming a signatory member also implies taking action to advance the UN Sustainable Development Goals (SDGs), eight of which Quadient is already committed to.

Quadient Launches Advanced Compact Folder Inserter and Cloud-based Document Integrity Mailroom Software

On 17 October 2022, Quadient announced the global launch of the DS-77 iQ, Quadient’s new compact modular folder inserter solution, and docsecure by Quadient mailroom software, the only fully cloud-based, closed-loop solution that tracks document integrity at every step, including proof that each mail piece has been properly processed.

YayPay by Quadient Listed a Technology Leader in the 2022 SPARK Matrix for Accounts Receivable Applications

On 26 October 2022, Quadient announced that its cloud-based solution YayPay by Quadient was listed as a 2022 Technology Leader by Quadrant Knowledge Solutions in the SPARK Matrix™ analysis of the global accounts receivable applications market.

The 2022 Quadrant Knowledge Solutions SPARK Matrix: Accounts Receivable Applications includes a detailed analysis of global market dynamics, major trends, vendor landscape and competitive positioning. The study provides competitive analysis and ranking of the leading accounts receivable applications vendors in the form of its SPARK Matrix. It gives strategic information for users to evaluate different vendor capabilities, competitive differentiation and market position.

Quadient launches Parcel Pending smart lockers in Ireland to support ongoing modernisation of the residential property industry

On 8 November 2022, Quadient announced the launch of Parcel Pending by Quadient in Ireland. By providing secure, self-service smart parcel lockers to businesses across the country, together with a dedicated support center and response and repair team, Quadient will help the Irish economy capitalise on the property boom by simplifying parcel delivery and improving residents’ experience.

With the Banking & Payments Federation Ireland (BPFI) expecting 50,000 new homes to be built across 2022 and 2023, Quadient will help property developers and property management organisations transform parcel pickup: providing a secure location for residents’ parcel deliveries with 24/7 access; in turn freeing up time for building management to deal with other tasks; and reducing the physical and environmental footprint of parcel delivery.